“The5ers offer community and support through interactions with fellow traders, mentors, and experienced professionals.”

When I was learning trading in my first two years, that was very tough. Ups and downs. I did all the bad trading habits like overtrading, overrisking, not journaling, etc. Here are some tips on how I avoid those bad trading habits.

By consistently practicing mindfulness and meditation techniques, I have learned to observe my thoughts and emotions without reacting impulsively. This has enabled me to make more rational and well-calculated decisions in the face of market fluctuations and unexpected events. Over time, I have become better at managing stress, avoiding impulsive trades, and maintaining a disciplined approach to trading.

What was your strategy to successfully pass The5ers’ evaluation?

One of the most pivotal moments in my trading career occurred during my transition from being a school math teacher to becoming a full-time trader. At the age of 21, I decided to pursue trading as a profession, leaving behind a stable job in education. It was a significant leap of faith, driven by my passion for financial markets and the belief that I could succeed in this challenging field.

We spoke with Tharindu about his trading plan, insights, and lessons gained while trading in the markets and our platform as a funded trader.

My mental and psychological strength lies in my ability to maintain emotional discipline and self-control during trading. I have worked on developing this strength through regular meditation practice, which has allowed me to gain a deep understanding of my emotional responses and thought patterns. Meditation has helped me become more self-aware and in tune with my emotions, which is crucial in the high-pressure environment of trading.

The journey was not without its challenges. I had to dedicate countless hours to learning and refining my trading strategies, managing risk, developing discipline, and practicing the meditation required to navigate the ups and downs of the financial markets. There were moments of doubt and setbacks, but they served as valuable learning experiences.

What made this moment truly special was the understanding that I had managed to translate my passion for mathematics and problem-solving into a successful trading career. My background in math provided me with a strong analytical foundation that I could apply to financial markets.

This YouTube channel helps me a lot when I practice meditation.

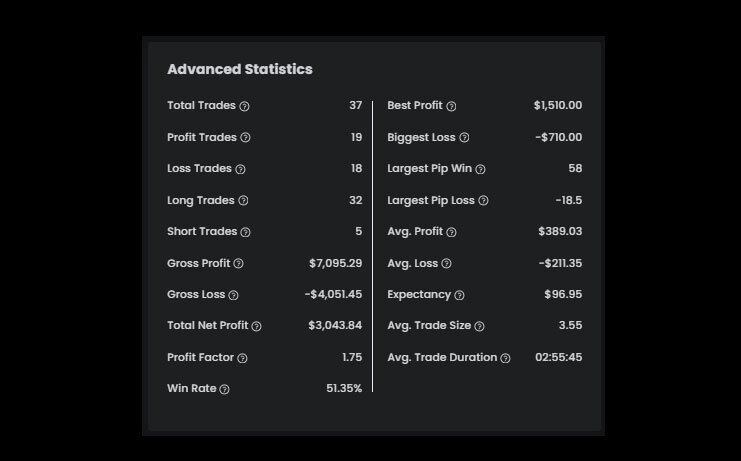

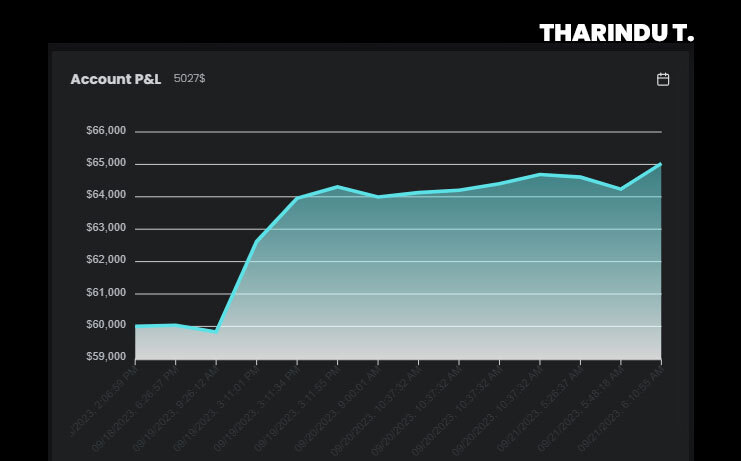

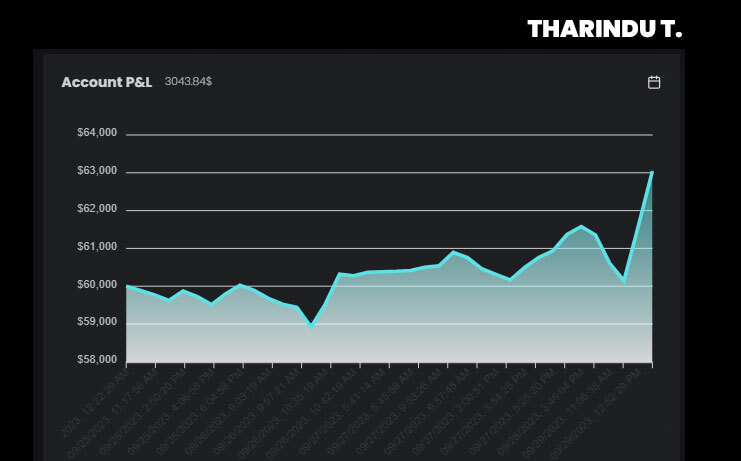

Tharindu $60K High-stakes Account – Phase Two

I am a full-time trader. I have been trading for 5 and a half years.

Briefly describe your Trading Plan and how it contributes to your success.

My name is Tharindu Tharuka. I am from Sri Lanka. I have been trading roughly since I was 21 years old. Currently, I’m 26 years old. Trading is my profession now, and I was a school math teacher before I entered to full-time trading.

How long have you been trading?

Click here for more Inspirations lessons and interviews from our professionally funded traders.

Watch The Interview With Tharindu

I’m using both smart money concepts and supply-demand-based strategy. No EAs and No indicators. Pure using price action. Firstly, go through high time frame analysis and follow the high-time frame market structure. Then, mark all the supply and demand areas in a High time frame. After that, wait till the price is mitigated to marked areas and then shift to a 15-minute market structure. If I notice there is a 15-minute momentum shift, I’ll enter to trade. Pretty simple always follow the same rules, and I only trade EU and GU. Because less is more. I always trade in the London session. One session and two pairs are enough for my trading style.

How is trading for The5ers different from trading by yourself?

04. Trading Hours: Establish specific trading hours and stick to them. Avoid trading during periods of low liquidity or when you’re emotionally compromised.