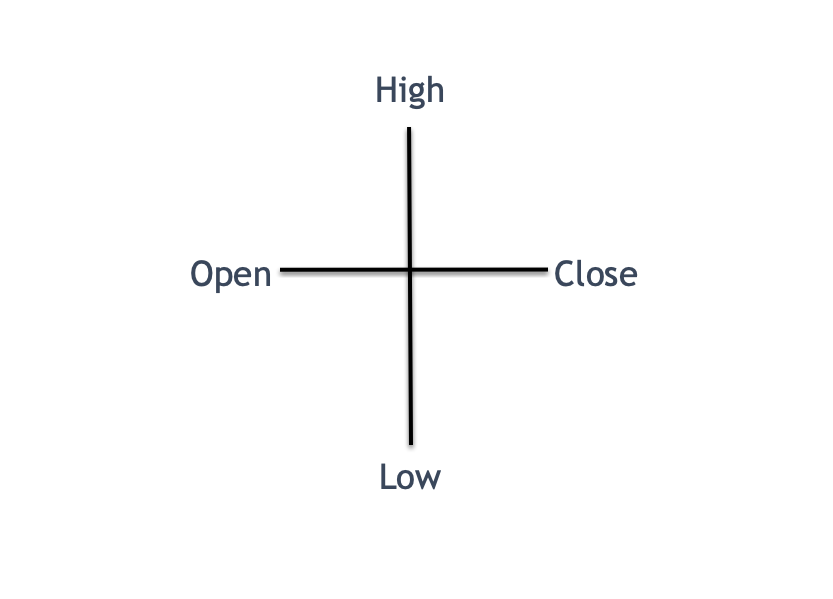

Traders need to use some common sense and judgment when defining how much differential between the opening and closing price they will accept for identifying a valid Doji pattern. This is because the exact opening and closing price for any given session is quite rare, therefore, we have to make room for some leeway in this area.

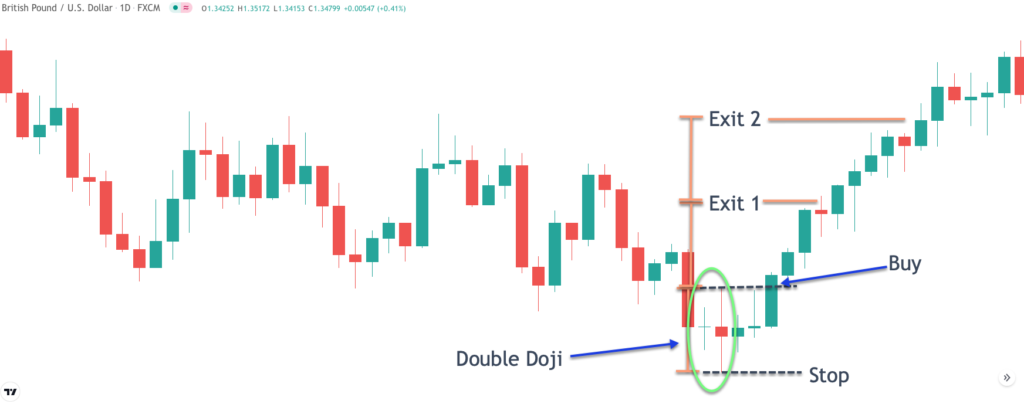

We will be using a two-tiered target as an exit strategy which calls for the first exit to be taken upon price reaching an equivalent distance of the double Doji pattern. Notice the second orange bracket which represents Exit 1. Price easily reach this level and continued to move higher. Exit 2 can be seen just above Exit 1 and represents a length of twice the double Doji pattern. Here again, price reach that level quite quickly after Exit 1 was achieved taking us out of the position entirely with a great result.

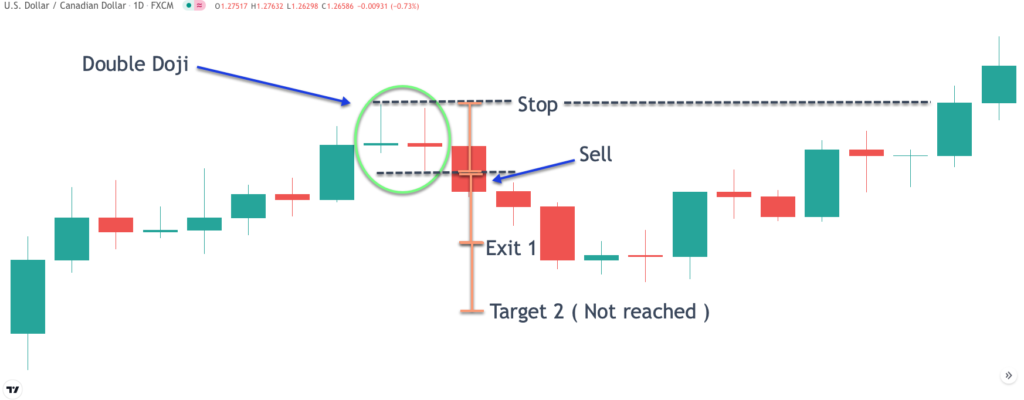

Bearish Doji Candlestick Trade Setup – USDCAD

Candlestick analysis is at the heart of many price action based trading strategies. There are a myriad of candlestick patterns that chart traders should be aware of. In this lesson, we’ve covered one of those important candlestick patterns – the Doji pattern. And as we learned, there are different variations of the Doji pattern as well.

One of the most common subsets of price action trading involves the use of candlestick patterns. Candlestick patterns offer valuable insights into the market action and can help traders position for the next price move. There are literally dozens of different candlestick patterns that traders can follow. One of the more common formations within this class of patterns is the Doji candlestick, which will be the focus of this article.

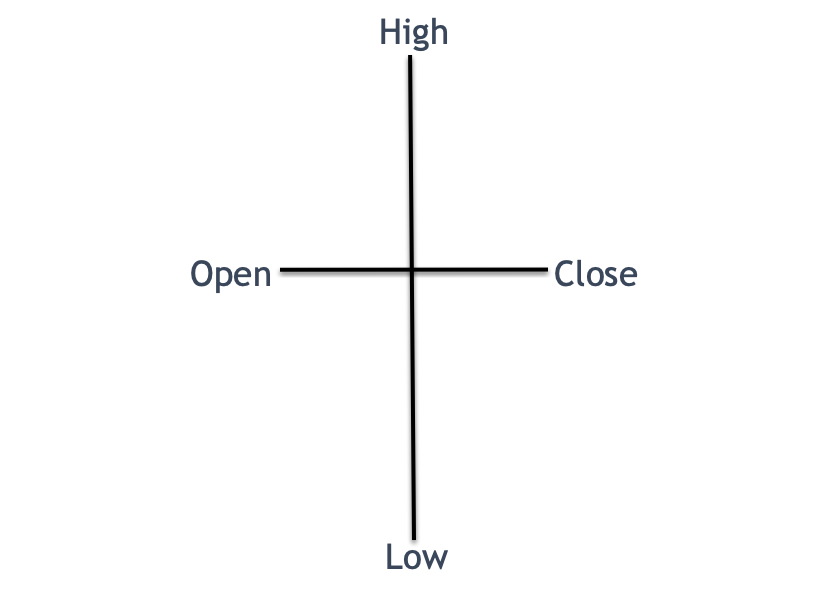

What Is The Doji Candlestick Pattern?

As we can see from the price chart below, the price of GBPUSD was trading lower, and then we see a period of consolidation before another price level lower that ultimately leads to the formation of a double doji pattern on the price chart. You can see the double doji pattern circled in green. As such, the first condition of this Doji trading strategy has been fulfilled. Specifically, a double doji pattern has formed at the bottom of the downtrend.

Unlike most candlestick patterns that either have a bullish implication or bearish implication the Doji pattern is somewhat different in that the formation does not provide any clear insights into the future price movement of a security. Essentially, the Doji candlestick pattern is a neutral pattern. Sometimes they can appear as a continuation pattern suggesting further price movement in the direction of the trend, or they can appear as a reversal pattern suggesting that a trend reversal is most likely.

More specifically, remember that most Doji patterns are generally indecision patterns, and thus when we have two or three Dojis appearing one after another, then that is indicative of a prolonged period of indecision, which is likely to propel prices in the direction of the eventual breakout. This is because the markets ebb and flow through periods of low volatility to high volatility, and from periods of high volatility to low volatility.

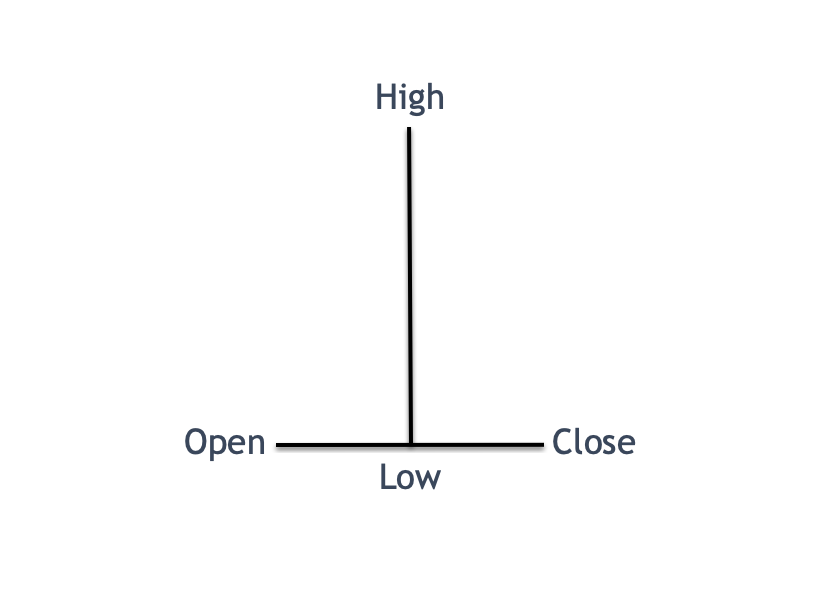

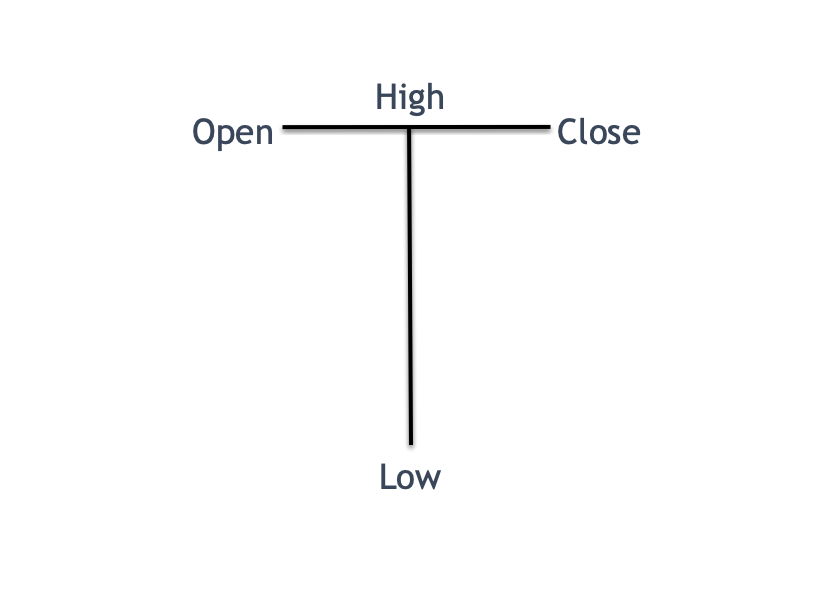

Gravestone Doji – The Gravestone Doji pattern appears as an upside down T pattern. Candlestick traders will recognize this pattern to be somewhat similar to the shooting star pattern. However, the Gravestone Doji pattern is a more powerful bearish reversal signal, as the open and close are at or near the low after prices were rejected to the upside.

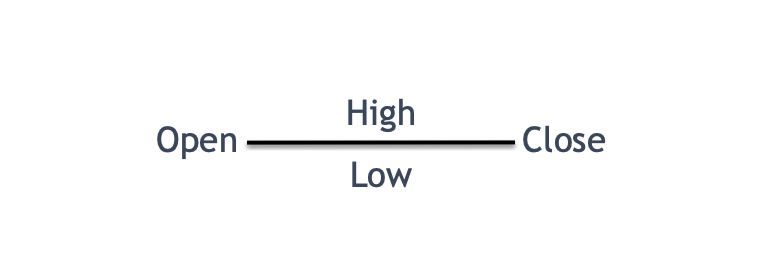

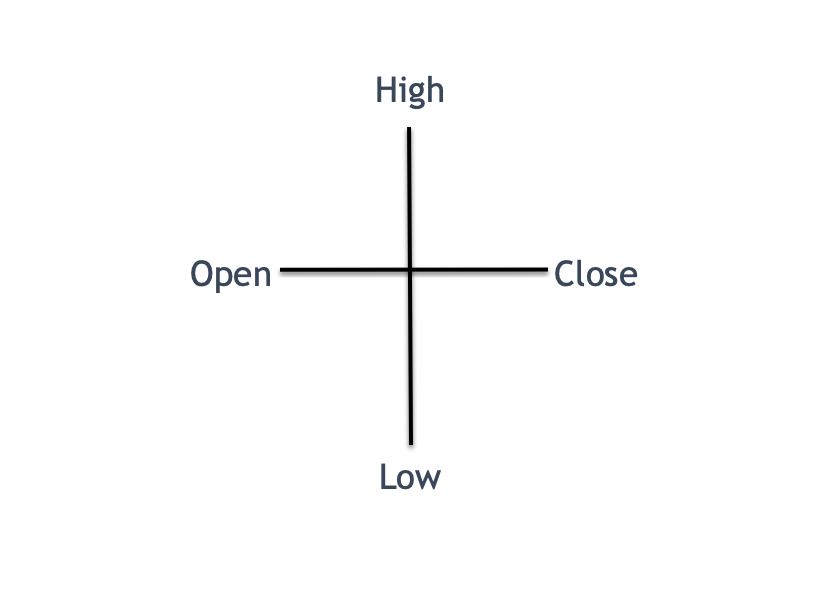

You can refer to the image below to see an illustration of the Long Legged Doji pattern.

When the Doji formation is coupled with the underlying trend in the market or some other technical based tools, we can in fact gather quite a bit of information from that and arrive at some bias for future price movement. And so, Doji candlesticks by themselves are not of much practical use, however, when coupled with other tools it can be quite useful.

With this backdrop, we will create a strategy for trading the Doji pattern that will take advantage of these periods in the market. Our strategy is based on a double Doji pattern, which is essentially any two consecutive Dojis appearing on the price chart. They should preferably be of a similar Doji variation; however, this is not a requirement. This double Doji system is a very simple price action based strategy that requires nothing more than the presence of two consecutive Doji patterns.

There are several variations of the Doji candlestick. The major types of Doji patterns include the Doji Star, Gravestone Doji, Long Legged Doji, Dragonfly Doji, and the Four Price Doji. We will be describing each of these Doji variations in the upcoming sections and illustrate the structure of each. Since each of these can have a different potential depending on the market context, it’s important to study them so that you can recognize and label them correctly on your price chart.

As a result, our target 2 was never reached on this trade. Remember target 2 is set at a level that is equivalent to twice the length of the double Doji pattern. Instead, as the price reversed and move higher, our stop loss was eventually triggered, taking us out of the position. In this trade, we wound up with a breakeven situation, because we were able to reach the reach Exit 1, however, we gave back those profits when our stop loss was hit.

Final Thoughts

Some traders find the Doji formation to be a bit frustrating to trade, because there is no clear bullish or bearish signal provided from it as a standalone pattern. But as you will learn shortly, there is a great deal of value that this pattern can offer traders if it is evaluated and implemented correctly. This is particularly true when the market displays a Double Doji or Triple Doji formation, wherein there are subsequent Dojis appearing in the price series.

Types Of Doji Candlestick Patterns

This is particularly true when the Gravestone Doji pattern appears in the context of an up trending market condition. In this case, it signals a potential change of trend from bullish to bearish. Below you can see an example of the Gravestone Doji chart pattern.

Long Legged Doji – The Long Legged Doji pattern has a similar appearance to the traditional Doji star pattern. They open and close occur at or near the same level, however, within the Long Leg Doji pattern, the wicks on either side are larger and extend out further. This suggests that the market is more volatile as prices were able to extend relatively far both to the upside and downside.

In this case, price immediately breaks lower on the very next candle following the double Doji formation. You can see that sell entry noted on the price chart. Now that we are in this position, we will make sure to protect ourselves in case of an adverse price move by placing a stop loss order in the market. Based on our strategy rules, the stop will be placed just above the high of the double Doji formation.

Vic Patel is a Professional Trader with over 20+ years experience in the markets. He is the founder and head trader at Forex Training Group. In addition to offering a premium FX Signal service, he provides advanced education through his in-depth trading course “High Probability Trading Using Elliott Wave and Fibonacci Analysis”.