We spoke with Antony about his trading plan, insights, and lessons gained while trading in the markets and our platform as a funded trader.

Click here for more Inspirations lessons and interviews from our professionally funded traders.

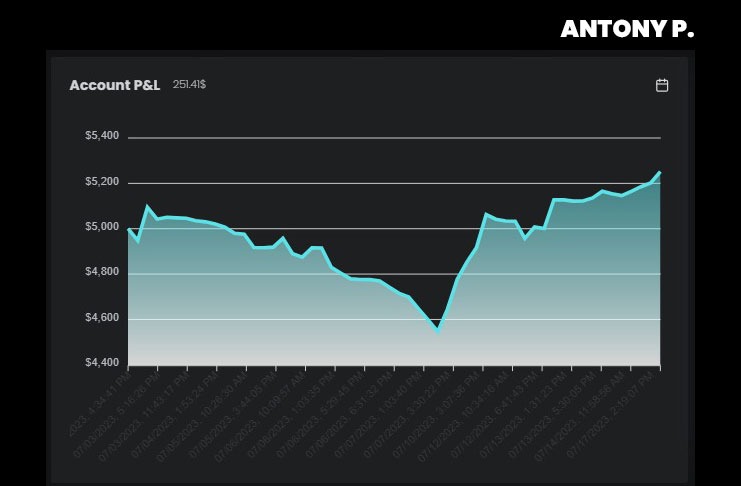

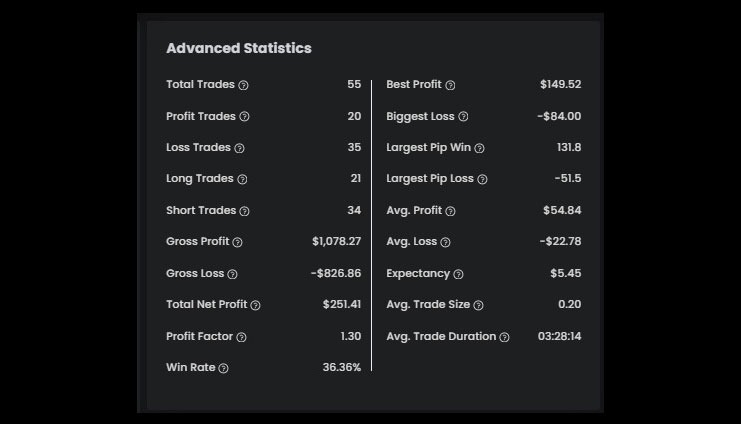

Antony’s $5K High-stakes Account – Phase Two

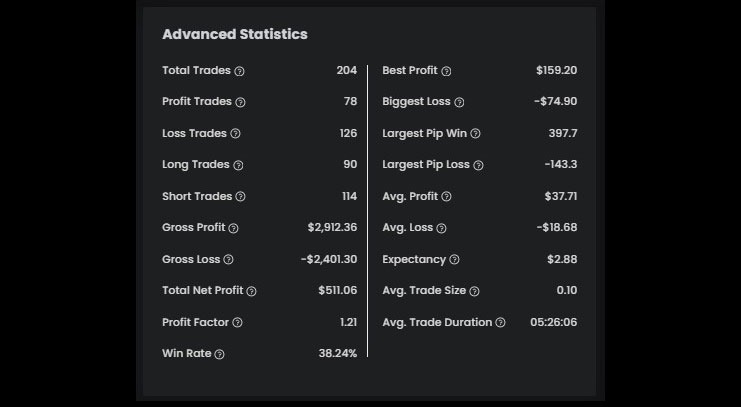

Antony’s $5K High-stakes Funded Account

Tell us a little bit about you.

I have a degree in economics and have been working in IT consultancy for 6 years; for about 2 years, I have been trading as a second job; it all started from curiosity and then became my passion. I spend hours near the charts studying continuously, and I don’t realize it; the key to success, in my opinion, is to love what you do, and I love trading.

How long have you been trading?

I am a full-time trader. I have been trading for 2 and a half years.

How did you recover from your deep drawdown in your second phase?

There is no perfect strategy; drawdown periods will always be present, even in the most profitable strategies. Many times, I have suffered heavy drawdowns, but the thing that will always save you is risk management; when I start to suffer drawdowns and my strategy does not perform well, I reduce my exposure to the market until I stabilize again and feel more confident.

Briefly describe your Trading Plan and how it contributes to your success.

When I’m trading, I always focus on risk management. Maintain strict adherence to risk management rules to protect my capital. I try to have as little income as possible in order to select the trades that most respect my setup, and finally, I also have very precise rules on when to stop trading so as not to burn any accounts; I have learned a lot from my mistakes.

Please share with us a challenge you faced in your trading career and how you overcame it.

I have overcome one challenge of a 5K challenge, and I am also overcoming another (I have just passed phase 1). I am starting with small capitals in order to increasingly get used to the numbers and to adapt my “financial thermostat.”

How did you adjust risk management to your trading personality?

I have overcome one challenge of a 5K challenge, and I am also overcoming another (I have just passed phase 1). I am starting with small capitals in order to increasingly get used to the numbers and to adapt my “financial thermostat.”

The things I focus on are the following:

1- I created a trading plan in which I open trades only if they respect my setups

2- I only trade on 3 pairs and one index (Nasdaq) in order to focus only on the assets that I observe and test every day

3- have a maximum daily risk of 1.5% (0.5% per trade); I don’t go beyond that because statistically, after 3 stop losses, you are emotionally compromised, and you try to recover the lost operations

4- after a negative day, I enter the market halving the risk; if I see that my strategy continues to perform, I return to my standard risk

5- As set up in the trading plan, I only operate in the London and New York sessions because, in those time slots, my setups occur several times.

Describe a key moment in your trading career

The key moment in my career came when I learned to accept my losses. I failed many challenges before achieving success because I didn’t know how to accept losses, so I traded, hoping to recover my losses after 2 years. I understood that trading is a full-fledged entrepreneurial activity; there are good days and bad days, and to be successful in this business, you also have to accept losses; once I understood this, I focused on risk management. I asked myself: “How willing am I to lose without being emotionally compromised?” I have set my standard risk; I don’t go beyond that; in this way, by following a very specific strategy, there are ups and downs, but if your backtests went well, your strategy is consistent, and you respect your risk, you will always, and I mean always be profitable. There are months in which I won’t be, and there’s no problem; I know that the statistical advantage is on my side, so I continue following my rules until I return to profit again.

How long does it take to become a consistent trader, and what aspects did you change that helped you become consistent?

2 years of trading, but I’ve been really consistent for 6 months.

What is your mental/psychological strength, and how did you develop it?

My mental strength lies in discipline; 10 years ago, I was very thin, I was almost anorexic, I had back problems, and the doctors told me that I had to have surgery because I had scoliosis. Alternatively, I could go swimming or start going to the gym. To avoid having surgery, I chose to go to the gym, and over time, I managed to gain weight by avoiding surgery; in recent years, I have developed the discipline and consistency in doing everything I love to do; trading is not easy, in fact, it took me some time to implement the things I have learned for other problems encountered in my life but if you have discipline, if you have very precise rules, if you are consistent and respect your rules you will be successful.

What was your strategy to successfully pass The5ers’ evaluation?

I’m using both smart money concepts and supply-demand-based strategy. I don’t use any Expert advisor. Pure using price action. Firstly, go through high time frame analysis and follow the high-time frame market structure. Then, mark all the supply and demand areas in a High time frame; I usually use Time frame H4-H1 for the structure and M15 for the entry if I have all my confirmations. For example, if the time frame H1 is long, I track my zones, I wait for the price to get there, and I first see how it gets there; if the setup is clean and respects my strategy, I go down the timeframe and go to the M15 waiting for it to realign from short to long in my zone, after which I will enter on the market.

I only trade on Nasdaq, EURUSD, or XAUUSD, as they are related assets. I evaluated the entry only on one of them.

How is trading for The5ers different from trading by yourself?

The advantage of collaborating with your company is that you give us traders the opportunity to trade with larger capitals, giving us the opportunity to increase our initial capital without risking a lot of money.

What would you recommend to someone who is just starting with us?

If you have a strategy and a trading plan, The5ers is the best because it is a reliable company, and if you are a profitable trader, they will always assist you because it always rewards those who demonstrate discipline.

Please share online resources that were/are significant in your trading development.

👉 If you want to receive an invitation to our live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our Newsletter.

👉 Click here to check our funding programs.

Follow us: 👉YouTube 👉 Linkedin 👉 Instagram 👉 Twitter 👉 TradingView

منبع: https://the5ers.com/how-to-recover-from-a-deep-dd/