Arbitrage trading attracts traders with its simplicity since it is enough to find an asset traded on several markets at different prices to make a profit. In arbitrage trading, both profitable and losing trades are possible, as in any type of trading.

New markets with less liquidity and weak regulation offer the best opportunities for private arbitrage traders. For example, the cryptocurrency market is less efficient than the stock market, which is more suitable for arbitrage trading.

In this article, you will learn the specifics of each type of arbitrage trading, explore popular trading strategies and determine the conditions under which a retail trader can profit from arbitrage trades.

The article covers the following subjects:

What is Arbitrage?

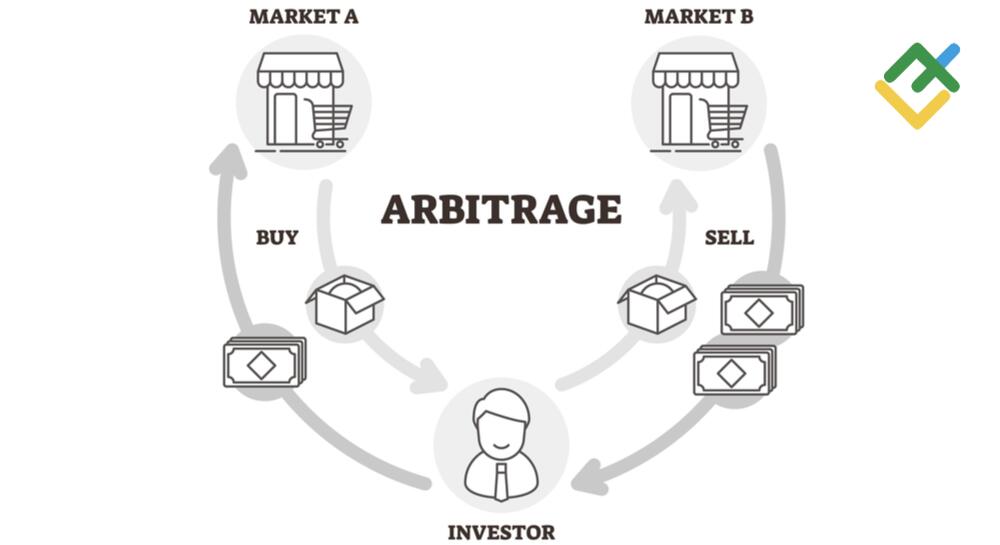

The goal of the arbitrage is to extract profit from the difference in prices for the same asset. A trader enters sales on a platform where an asset is traded more expensive and, at the same time, purchases the same asset where it is cheaper.

Physical retailers are a real-life example of arbitrage. For example, dealers who buy used cars cheaper in one country and sell them more expensive in another.

Arbitrage trading involves buying and selling stocks, currencies, derivatives, and cryptocurrencies. If the company’s stock is traded on the New York Stock Exchange at $5 and on the London Stock Exchange at $4.7, this is a great opportunity to enter arbitrage trading. Provided that the profit exceeds the costs.

As a rule, transaction speed is very important in arbitrage trading. A powerful computer, high-speed internet, and automated trading programs can be advantageous. Manual arbitrage is profitable in new markets, such as cryptocurrency, and unprofitable in developed and efficient markets, such as the stock market.

What is Arbitrage Trading in Crypto?

Crypto arbitrage trading is based on opening opposite trades with the same cryptocurrency but on different exchanges. Therefore, during crypto arbitrage, it is necessary to have a deposit on at least two crypto exchanges.

The crypto market is highly volatile, so the discrepancies can be more significant than on the stock or currency exchanges. Also, this market is not strictly regulated by law, so people are reluctant to transfer their investments there. As a result, low liquidity allows price discrepancies to remain longer than in developed markets. The volatility and liquidity of the crypto market still make it possible to earn on arbitrage, even for manual traders.

The general idea of crypto arbitrage is to find cases where the same cryptocurrency has a different price on two different exchanges. Since arbitrage traders sell an asset with a higher price, they increase the supply, pushing the price down. The second trade is the purchase of an asset at a lower price, which means an increase in demand and upward pressure on the price. Thus, the more arbitrage trades are concluded, the smaller the price discrepancy will be. Therefore, a crypto arbitrage trader must learn to identify such situations and enter relevant trades quickly.

Crypto Arbitrage Trading Risks

The main risks during crypto arbitrage trading are security and timing.

As participants in exchange trading, crypto arbitrage traders are exposed to the risk of fraud associated with hacking accounts and crypto exchanges. Also, crypto arbitrage traders run the risk of losing their funds in case of the dishonesty of a crypto-broker who can close the company by stealing clients’ money. Since the cryptocurrency market is poorly regulated by law, pay close attention to security, namely, choose brokers with a high reputation and protect your account with additional verification.

The execution of arbitrage trades is associated with timing risks. Traders can take advantage of crypto arbitrage trading in two ways:

The more time has passed since the opportunity to enter arbitrage trades appeared, the more traders will sell the asset at a high price and buy at a low one. Because of this, the price difference and profit potential will decrease. The arbitrage trade may become inappropriate at some point, as the profit potential will not cover the costs.

The costs include various commissions a trader pays during arbitrage trading, such as opening a trade, transferring funds between exchanges, or withdrawing funds from a trading account.

Arbitrage Trade Example

Below is an example of crypto arbitrage trading:

-

Deposit on exchange 1: 15,000 euros + 1 BTC.

-

Deposit on exchange 2: 15,000 euros + 1 BTC.

-

The price of 1 BTC on exchange 1 = 15 000 euros.

-

The price of 1 BTC on exchange 2 = 15 100 euros.

After buying 1 BTC on exchange 1 and selling 1 BTC on exchange 2, the trader’s deposit will be:

The profit was 100 euros, but now there is only BTC on exchange 1, and only euros on exchange 2. Therefore, a trader will not be able to either sell BTC on exchange 2 or buy it on exchange 1. Therefore, when calculating profits, one should consider the costs of transferring 1 BTC to exchange 2, for example, using decentralized exchanges and transferring 15,000 euros to exchange 1 to restore the ability to buy and sell BTC on both exchanges.

Types of Arbitrage

There are several types of arbitrage trades:

-

classic arbitrage refers to investment and financial markets;

-

retail arbitrage occurs when a product is bought in one type of market and sold in another;

-

merger arbitrage is related to the corporate takeover process;

-

convertible arbitrage refers to convertible bonds and their properties;

-

triangular arbitrage refers to the foreign exchange market and its main instruments, currency pairs.

Pure Arbitrage

Pure or spatial arbitrage is an inter-market arbitrage of the same product if its price is not the same in different markets. For example, stocks of large companies such as Sony are traded on several exchanges. The opportunity to enter spatial arbitrage will arise if the Sony price on the Tokyo Stock Exchange (TYO) is lower than on the New York Stock Exchange (NYSE). Spatial arbitrage, in this case, is a purchase of a security on TYO with a simultaneous sale of the same security on the NYSE.

Pure arbitrage is also possible when trading currencies and cryptocurrencies. Operation times of some trading sessions in the Forex market coincide with each other. For example, the American market opens before the European one closes. As a result, the euro can be traded in Europe and America at different prices.

A price difference between highly liquid and low-liquid exchanges is also possible during crypto arbitrage. For example, buying/selling BTC on the highly liquid Binance is 16739.07/16739.56, and on the less liquid Bitfinex is 16740/16742. Therefore, it is possible to buy BTC on Binance at 16739.56 while selling on Bitfinex at 16740 using a less accurate quote.

But due to the development of automatic processes, the differences in inter-market prices are getting smaller every day, so pure arbitrage, especially manual, is becoming rare.

Retail Arbitrage

Retail arbitrage is popular when trading physical goods. For example, a person can buy a physical product in a local market and then resell it to a final buyer in another city at a higher price.

The benefit for the final buyer is that the amount of the margin is less than the potential cost of traveling to another city or country for the desired product. Since the sell trade occurs later than the buy trade, profit in retail arbitrage is a reward for taking on several types of risks. The first risk is associated with the number of people who want to buy this product. The second concerns the opportunity to resell the product at the right price.

Merger Arbitrage

This type of arbitrage trading occurs when one public company acquires another. Under the terms, the acquiring company must buy back the stocks of the target company (the one being sold). The purchase price is usually set above the market price so current shareholders can profit.

When information about an acquisition becomes public, arbitrage traders start buying shares of the company that is being sold, as they expect the price to rise to the share repurchase target. Further, when the target price value is reached, the buying company becomes the counterparty of arbitrage traders. The possibility of a successful transaction is not guaranteed due to blocking by regulatory authorities or due to force majeure. Therefore, arbitrage traders cannot be sure that they will be able to sell the asset at the stated buyout price.

Thus, the more the current price differs from the buyout one, the greater the potential profit for merger arbitrage.

The opposite of the classic merger arbitrage is going short on shares of the company that is being sold. If the trade fails, then there is a possibility of a sharp price decline, on which the investor can earn. However, such a transaction cannot be considered merger arbitrage in full since there is no future price value, and it is impossible to calculate the potential.

Convertible Arbitrage

Convertible arbitrage is associated with convertible bonds. Convertible bonds are securities issued by companies to attract additional investment. They can be converted into shares of the issuing company. This is their main difference from standard bonds. The interest paid on convertible bonds is generally lower than on traditional bonds. However, conversion into shares may be carried out at a reduced rate.

The opportunity for convertible arbitrage arises as the current share price is usually higher than the bond’s conversion price. A bond purchase trade is concluded simultaneously with a share sell trade.

A possible increase in the share price after the conclusion of the trade will be partially offset by payments for holding the bond. On the other hand, some bonds can only be converted into shares with a delay. During this time, the arbitrage trader will be exposed to the risk of the conversion price increase.

Another type of risk is associated with a downgrading of the company’s credit rating. In such cases, stock prices usually fall faster than bond prices. Therefore, if this happens after the opening of the arbitrage trade, the investor may suffer losses.

If the bond is overbought, arbitrage can be carried out by purchasing the underlying stock and selling the convertible bond.

Triangular Arbitrage

Triangular arbitrage is used when trading paired instruments when the price of one is expressed in terms of the price of the other. For example, EURUSD, GBPUSD currency pairs, or BTCUSD, BTC/USDT cryptocurrencies.

The purpose of this type of arbitrage trade is to find the difference in price between three paired instruments. For example, BTCUSD = 16716, ETHUSD = 1216. Based on these data, the BTC/ETH rate should be 16716/1216 = 13.75.

Suppose the actual BTC/ETH price = 13.8, i.e., more than the calculated price of 13.75. To make a profit through triangular arbitrage, you need to make three transactions:

-

buy BTCUSD at 16716 USD. For example, we buy 10 lots for the amount of 167160 USD;

-

sell BTC/ETH at 13.8 ETH. 10 lots for the amount of 138 ETH.

As a result of these transactions, there are 138 ETH in the account and a debt of 167160 USD. Therefore, in the third trade, get rid of ETH and close the USD debt. Hence:

The debt was 167160, and the profit from the third trade was 167808 USD. So the triangular arbitrage profit was 167808 – 167160 = 648 USD.

If in this example the actual price of BTC/ETH would be lower than the calculated one, that is, 13.7 (with the estimated 13.75), then the direction of transactions in the triangular arbitrage would be as follows:

Pros and Cons of Arbitrage

The main criterion for successful arbitrage trading is high speed. The faster traders find arbitrage instruments and the faster they enter a trade, the greater the profit potential. For this reason, arbitrage trading is not suitable for manual traders, as they will lose in terms of speed to programs.

Pros of Arbitrage

Unambiguity

Compared to standard trading, in which some people see “head” and “shoulders” on the price chart, while others see horizontal levels, in arbitrage trading the search object is a discrepancy in prices.

Less uncertainty

In classical trading, there is a possibility of both a positive and a negative outcome for each individual trade. The result cannot be calculated in advance. In arbitrage trading, the success of a trade depends only on the speed of its conclusion.

Cons of Arbitrage

Costs

For profitable arbitrage trading, traders must either spend money on good software that automates trading or look for opportunities for manual trading. Compared to classical trading, setting an alert in arbitrage and waiting for the right situation to conclude a deal is impossible because you need to act immediately.

Execution risks

Like any type of short-term trading with little profit potential but high volumes, slippage, requotes and loss of internet connection occur during arbitrage trading. Even a small uncontrolled change in the situation can have negative consequences for a trader.

Arbitrage Trading Strategies

Let’s consider several arbitrage strategies that do not require a high speed of concluding trades. These are risk arbitrage, fixed income arbitrage, and covered interest arbitrage.

They can be called analogs of intraday and medium-term strategies in classical trading since the position holding time can range from several days to several months.

Risk Arbitrage Strategy

Risk arbitrage strategy is based on merger arbitrage when one company plans to buy back the shares of another company at a predetermined price that is higher than the current market price. This strategy consists of buying shares of the company being acquired in the expectation that the transaction will occur. The greater the difference between the price indicated in the transaction and the current market quotes, the greater the profit of the arbitrage trader. Nevertheless, this strategy involves the risk of canceling the trade, as a result of which the arbitrage trader will not receive the planned profit.

For example, at the moment, the company’s shares that will be bought out are traded at $50 per share. If the price of $52.5 is indicated in terms of the trade, such a security suits for risky arbitrage. Suppose a trader opens a long trade on 10 securities with a current value of $500. Before the merger date, the share price can fluctuate up and down. Traders must conclude a transaction with such a volume that they have enough funds to hold an open position, considering these fluctuations. If the transaction occurs, the trader will exit the trade at $52.5, getting $525 for 10 shares. If the transaction does not occur, the trader must close the position based on the market situation.

Thus, in the risk arbitrage strategy, only the take profit level is known, that is, the price specified in terms of the transaction.

Fixed Income Arbitrage

Fixed income arbitrage is based on the difference in interest rates between different types of securities, such as stocks and bonds.

Unlike the previous strategy, the fixed income arbitrage forecast is not based on exact data but on the traders’ assumptions. Trades are opened according to the standard arbitrage scheme, which implies that a more expensive security is sold, and at the same time, a cheaper one is bought in order to make a profit.

Assume the yield of bond 1 is 4% and of bond 2 is 3.5%. Also, issuers of securities operate in the same industry, have similar logistics, and approximately the same profit. Therefore, arbitrage traders may assume that the actual future returns for both securities will be the same. They then enter a long Bond 2 trade (with a 3.5% yield) and a short Bond 1 trade (with a 4% yield). If the bond price matches, traders will make a profit of 4 – 3.5 = 0.5%.

Traders will also make a profit, albeit smaller, in case of convergence of profitability indicators by any amount. If the spread between profitability values, on the contrary, increases, then the arbitrage traders will incur losses.

Covered Interest Arbitrage

This strategy is based on the difference in interest rates between the two countries. Suppose the annual percentage rate in country 1 is 5% and in country 2 is 15%. Most likely, the annual rate on deposits in country 2 will be about 10%.

Thus, an arbitrage trader can take a loan in the national currency at 5%, then buy the currency of country 2 and deposit this amount at 10%. At the end of the deposit period, the trader withdraws money, converts it back into the national currency, and repays the loan.

If the exchange rate at the time of withdrawing money from the deposit remains the same, then the trader will earn 10% – 5% = 5%. A potential change in the exchange rate serves as a currency risk. For example, if the currency of country 2 falls during the year by 5% against the currency of country 1, then the profit will be zero.

This currency risk is hedged using a forward contract for the amount of potential profit. An annual contract in the amount of 5% of the deposit is used as an example above. A trader’s net profit is the income from arbitrage trade minus the cost of the forward contract.

What Are Arbitrage Opportunities in the Stock Market?

Five types of arbitrage are used at the current stage of development of the stock market:

-

During the inter-exchange (pure) arbitrage, the difference in the price of the same asset on various exchanges is tracked. Their features have been discussed above. To calculate profitability, remember that an asset can be traded in different currencies on different exchanges, which implies conversion costs. The second expense item is the transfer of securities between depositories.

-

During the intra-industry arbitrage, price divergences are tracked between various highly correlated assets. For example, shares of companies in the same industry. This arbitrage type is based on the assumption that stocks will move in the same direction, according to the industry’s current state.

-

During the equivalent arbitrage, the price difference between the underlying asset and its derivative is tracked. For example, between a stock and a future for it. This type of arbitrage is based on the fact that the futures price approaches the underlying asset’s price the stronger, the closer the expiration date is, and becomes equal to it on this date.

-

During the calendar arbitrage, the price difference between futures with different expiration dates for the same asset is tracked. With a strong divergence, a more expensive contract is sold, and a cheaper contract is bought based on convergence. If the spread is narrow, then the opposite is true — a more expensive contract is bought, and a cheaper one is sold based on the price difference.

-

Statistical arbitrage is based on the principle of price reversion to the average value. A short trade is opened for overbought shares, and a long trade is opened for undervalued shares.

How To Do Arbitrage Trading

To successfully engage in arbitrage trading, follow the recommendations below:

-

Decide on the type of transactions, manual or automatic.

-

Choose a market, considering the type of transactions and the number of commissions. In the case of automated trading, take into account the costs of hardware and/or software.

-

Compare the potential profit in a trade with the cost of its conclusion.

-

Determine the risks associated with the trade. Try to reduce them if possible.

-

Make a series of trades on a demo account to compare actual profits with planned ones.

-

In case of a positive result, enter trades on a real account with a minimum volume in order to evaluate the impact of the spread and psychology on the result.

-

If the result is satisfactory, switch to standard volumes on a real account.

Conclusion

The main dilemma in arbitrage trading is choosing between investing in equipment and investing in your skills. Automated trading requires either a larger deposit or more trades to achieve a rate of return. During the types of manual arbitrage that are not demanding on speed, the deposit can be commensurate with standard trading.

Arbitrage, like any type of trading, comes with risks that must be considered.

The cryptocurrency market is the most promising for both types of arbitrage. It is still underdeveloped, which means that the competition in both automatic and manual arbitrage is lower than in such developed markets as stock or foreign exchange.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

منبع: https://www.litefinance.org/blog/for-beginners/arbitrage-trading/