Ultimately, we get to make the decision for where and when to act in the market and at what price to place our positions, targets, and stops. We also get to choose when to enter and how we set the tolerance level for our criteria to take any action in the market.

Analysis

We control how thorough and reasoned our analysis is. If we invest the proper time and knowledge into it, we’ll be able to come away with a well-educated analysis and assessment.

Plan Risk-Reward

Increase your trading efficiency by selecting only the best of your trades. Let missed signals run without you and avoid being dragged into long and choppy markets because you had entered prematurely.

Here is a helpful table showing uncontrolled and controlled elements in trading:

Be honest with yourself when you begin putting a strategy together. If you want your plan to lead you on a long and prosperous trading path, it must be realistic, achievable, and adaptable.

Remember that whatever sizing (leverage) you use, make sure you leave enough room for managing catastrophic price movement against you.

Check the clock and always Be aware of the session hours. Also, keep an eye on the economic release calendar and how and when you might possibly be exposed to sudden fluctuation.

Dealing with this great unknown and uncontrolled environment can be intimidating and awaken many psychological issues regarding how we deal with these situations.

It is our decision to filter out trades that are not deemed to provide a sufficient risk-reward ratio. We can act upon improving the risk-reward ratio by waiting a bit longer and taking the trade at a deeper price which will give less risk range. By that, we can increase the risk-to-reward ratio even more.

Position Sizing

Respecting your trading plan is a risk management necessity. Discipline when following your plan is key for consistency because, without persistence, you cannot measure your results. Without measured results, it’s impossible to perform an efficient forensic analysis that could help you improve your decline and fix your risk management plan.

Cherry Pick your trades. Less is more

There are a few important guidelines to follow in order to build a comprehensive risk management strategy.

Risk Management fundamentals for successfully trading forex

Trading usually requires a high level of focus, commonly referred to as being in the zone. But there is a world out there that keeps turning regardless of whether we’re in it or not. Kids, parents, spouses, friends, neighbors, bosses, weather, traffic, etc., anything can suddenly interact with you and distract you from trading.

Life Circumstances

To overcome the un-controlled and steady lack of crucial information and control, we have to adopt a set of rules and policies that give us a head start in defeating these problematic variables.

How to Build Risk Management Trading Strategies

A basic rule of thumb is to set a minimum risk-reward ratio that is achievable and is aligned with your strategy win rate.

When the price moves in a strong manner, we can only see it after it happens. It’s almost impossible to get a heads-up before a major move occurs, and our position will always be exposed to such rough events at any given time. Once we are in a trade, while the price moves, we cannot really do anything as it happens.

Unexpected News

Risk Management Trading Strategies – Face it, things rarely ever go according to plan. This truth is even more so in the world of trading. If you refuse to accept this reality and if you don’t work tirelessly on a solid trading plan with an effective action plan that covers as many possibilities as you might run into while trading, you are not going to survive as a trader.

We can work diligently mapping market situations, conditions, and or action plans in response. This is so we can always be prepared with proper and tested actions for whatever scenario might arise. It is never enough to emphasize the importance of this and how vital it is to a trading plan.

Training Your Psychological State

There are endless examples of scheduled economic news releases that cause the market to move in a direction opposite that common sense. For example, if the data indicates strengthening a currency, the actual market reaction might be to devalue that same currency. There is little to no logic to how the market reacts to expected data.

Breaching Final Target

Being prepared for the mental aspects of trading is vital as well. Knowing your mental strengths and what you can put to use in which situations is key. This also means being aware of the mental weakness you need to work on and how you can go about doing so. Mapping and knowing these elements and their implications is a handy tool to stay on top of your mental game.

Setting Stops

Capping your risk is also something that’s definitely done by your decision. So are shifting and securing profits with stops and setting stop loss and targets (take profit) in realistic locations relative to the market conditions. It’s important to make sure you’re setting stops and shifting them only in the direction that is proven to be beneficial for long-run risk management.

The Time You Trade

Respect your trading plan

Here are some of the major terms you must resolve for yourself:

Know your Current Goals (vs. the future)

Your psychological readiness for the day, the week, or for specific events can hit you by surprise. After all, we’re human, and as such, we’re emotional creatures.

Exterior interferences

You may use some of the profit from your past trades to scale up to your next trade position. However, this should be constrained to the probability level of the next trade. Do not compound profits under any circumstance. Patience is key in trading, so never rush the process. Take only what the market gives and do not try to artificially enhance what it gives.

Once you understand what is and isn’t under your control, you can begin to map a realistic goal for your trading. Assessing your goals and determining which are achievable and which are not will set you in the right direction toward sustained success. Identifying real goals is the cornerstone for building your risk management strategy.

Fortunately, there are a few things that we do get to have control over when we’re trading. One of our main goals should be to use these tools in the most efficient way to give ourselves a real edge in order to maintain a healthy business.

Timing The Entry / Exit

Now that the importance of risk management is clear let’s go through the tools we have available to us in our fight against uncertainty. We can never eliminate it completely, but we can put up several safeguards to ensure the damage is limited.

Be patient and thoughtful, and work towards creating a sound and reliable trading plan. With it, you’ll always have a guide through your trading career. A good risk management strategy can be your lifeline in times of trouble and a steady hand in smoother markets. Work on it, trust it, and improve it for a longer and more productive trading career.

Targets should be set within a few time parameters. This means mapping the course for single, daily, weekly, monthly, and annual trades.

Setting trade targets does not guarantee prices will reach it before they reach your stop loss. We have no control over what path the market takes. If you’re aiming for a specific RRR, it’s not guaranteed you will get it as expected.

Unaware / Not Trained

We wrote a great article about how compounding work.

Risk Reward Ratio

You’ll know your sizing is right when you feel comfortable holding it, and there’s no anxiety when you’re in your risk zone. You’ll also know because you’re not taking low pips to count on profit since the value is high enough.

Always acknowledge that there are more aspects that you’re not aware of that will affect your trading and expose your position to risk. Eventually, you will be able to spot new blindspots as they begin to form, but you might lack the proper training to deal with them. In this case, just acknowledge that these events can pop out of the blue and surprise you.

Psychological State

Risk Management Trading Strategies – The Bottom Line

Good risk-reward ratio discipline will lead you to trade with higher efficiency, a higher success rate, less stress, and faster conviction regarding whether your trade succeeded or not.

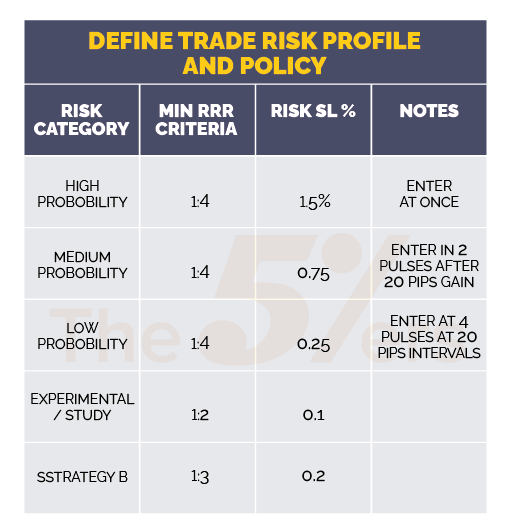

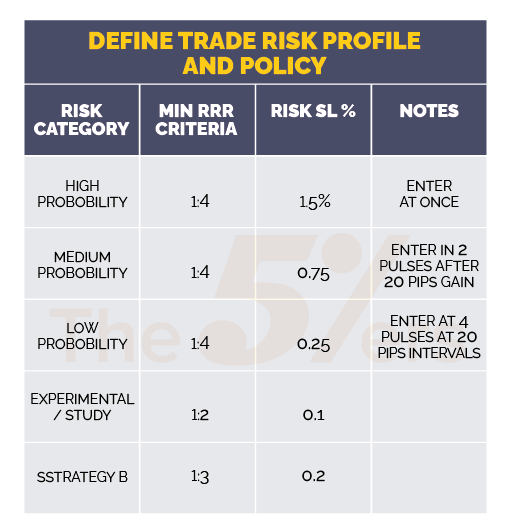

Define Trade Risk Profile and Policy

👉 If you want to receive an invitation to our live webinars, trading ideas, trading strategy, and high-quality forex articles, sign up for our Newsletter.

We can never time when all the right conditions align to trigger a trade (or exit). This sometimes results in traders doing things like missing the entry and jumping late on a trade or prematurely entering a trade. Entering the market prematurely or late may expose you to greater drawdown with a poor risk-reward ratio.

Available Information

Lastly, for position size, never use it to compensate for past losses.

Compounding

What are your expectations from trading in relation to your account size? It’s obvious you can’t expect to make a 5K monthly income from a 10K account, right? If you try to do so, you’ll overwhelm yourself, over-trade, and push yourself to intense frustration.

👉 Don’t miss our Forex Trading Ideas.

We decide how much we size a position. It’s at our discretion to set the margin for error and drawdown. There are strategies that can be used with position sizing, such as gradually scaling in once the trade is on profit or using different sizing upon the risk class, e.g., for the more risky class will take half or a quarter of the regular sizing.

Known Economic News Releasing time

Follow us: 👉YouTube 👉 Linkedin 👉 Instagram 👉 Twitter 👉 TradingView

منبع: https://the5ers.com/risk-management-strategies/

Set position size according to the probability of success for your trade. The higher the probability of success, the higher the leverage you may use. Conversely, the lowest probability trades should use lower leverage.

Setting a realistic goal should minimize your stress and enable you to recover and deal with the unexpected should things not go according to plan.

It can also be helpful to break down your goals into milestones. Small accomplishments that eventually hit larger goals are a great way to avoid frustration and calmly and successfully achieve what you’re after. Realistic goals can always be met, and it just might take you a different, more incremental route to get there.

Choosing which asset corresponds with your trading policy, your trading plan, and risk management is the last item on our list of controllable elements. You can choose to trade only qualified assets that will give you the best probability of rewarding your efforts.

Understanding Controllable and Uncontrollable Elements

As retail traders, we are always on the short end of receiving the relevant information that can affect our trade assessment. Information such as increasing volume is just not available for forex trading. The order deal book is also not transparent, and major players’ activity cannot be seen. Since forex has no governing authority, institutions are not reporting based on their best interests and can work with a high level of secrecy. Retail traders like us are left only with access to public information, such as chart reading and macroeconomic data. We simply don’t have an information edge.

Reasons for Price Volatility

A big part of that survival comes from planning and crafting a well-thought-out and extensive risk management trading strategy. When you trade, it’s imperative that you know what risks you’re willing to take and how you will manage if something goes wrong along the way. Risk management strategies help you identify and tackle outcomes that might otherwise have caused catastrophic damage to your account.

Why is Risk Management So Important?

This is another key element to eventually getting your trading to be more efficient and less stressful.

While in the trade

On the other hand, the controlled elements are the tools that help us restrain and reduce the risks, rig (or cap) them into a framework that allows us to maintain a healthy trading portfolio.

The same thing goes for unexpected news events that affect our positions. We can never know when they’re about to erupt and in which direction they’ll move the market in.

Unexpected Economic Data Interpretation

Once you understand what is and isn’t under your control, you can begin to craft a risk management trading strategy that utilizes the controllable elements while minimizing the potential effects of the uncontrollable elements. Remember that loss is a part of trading, and you will never be able to completely rid yourself of unplanned events. The goal of a great risk management plan should be to account for these unknowns and manage the damage they might cause.

The Importance of Setting a Realistic Goal

Risk Management Trading Strategies

Once a trade has run its course, take a long look back and perform an in-depth forensic assessment of your performance. It’s important to always be on top of your performance so you can recognize any areas of weakness which will need to be worked on.

Your current goal should be something that allows you to grow your portfolio to the point where you can achieve your bigger goal, which is to withdraw 5K every month. Set a current goal that is realistic and does not pressure you in terms of position sizing, screen time, and growth pace. Make this work while also allowing you to grow personally and enjoy a normal life.

Every trade you plan should fall into a risk profile definition category. Each category has its own parameters for how much risk should be taken.

Set Realistic Targets and know your boundaries

You can decide when, where, how long, and under what settings you want to trade in. You can and should choose to trade at the times that are most welcoming for your trading strategy, goals, and availability.

Choosing an Asset to Trade

This may cause us to react differently from situation to situation depending on how we are emotionally triggered at a certain time.

Now let’s dive into each of these elements a bit (Later in the article, there are solutions on how to handle each situation).

Condition to Trigger

For instance, you can set risk categories like this:

👉 Click here to check our funding programs.

After you identify the times in which you could be vulnerable to these events, know exactly what you will do if you’re exposed. It’s crucial to have a plan for each different scenario as your trade evolves.

Post trade and post session

Always remember that risk management strategies are individual and subjective resolutions. They rely on your own personality, strengths, weaknesses, account size, and goals.

Trading takes place in an intense work atmosphere, surrounded by various aspects of uncertainty and constant surprise. In our work as traders, we will never have full access to all the information that is needed to make a completely sure decision. Simply put, trading is speculating, and the outcomes of our actions are no longer in our hands once we have set a trade into motion.

Maybe you’re facing a challenging period in your life, yet you have to be trading professionally and putting in the needed time, effort, and focus to make it work for you. Life circumstances will not always be optimal to support your demanding task of trading.

The Controlled Elements in Trading

As a thumb rule, know that if you wait too long for a deeper entry, you might miss out on some trades, but if they’re triggered, the result will be a much better risk-reward ratio, with a higher success rate.

Once you’re in the trade, Keep analyzing your chart and constantly assess the probability of your trade.

In trades that went well and performed according to plan, there will still be places where you can learn from the successful experience. Find ways to reward yourself for a job well done and always be proud of your accomplishments.

We can time how we secure our exposed position during major economic releases. The schedule of these events are pre-planned and published ahead of time, so we have plenty of time to stay out, progress stops and targets, reduce exposure or any other mean of protection from the upcoming high volatility.

Developing & Following your own Trading Plan

The targets that you set in these parameters should also be set for the losing side. Ask yourself at what level you should halt trading and for how long. Also, know what you need to modify before you allow yourself back in the game.

Position Size

However, if your goals are not realistic, it may lead you to take unnecessary risks in your trading. These risks might include overexposing, over-trading, and avoidance of taking profits or neglecting your own stop loss.

In trading, all uncontrolled elements are considered risks. These are the factors that can always go against our trade, even if they were unknown prior to entry.