- Despite temporary rebounds, the EUR/USD pair maintains a bearish bias in the short term.

- A new lower low activates more declines.

- The US NFP, Unemployment Rate, and Average Hourly Earnings should move the rate.

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

منبع: https://www.forexcrunch.com/blog/2023/12/08/eur-usd-price-in-demand-zone-all-eyes-on-us-nfp/

Yesterday, the US and the Eurozone reported mixed data. The US Unemployment Claims came in at 220K in the last week versus 221K expected but above 219K in the former reporting period. At the same time, the Eurozone Revised GDP reported a 0.1% drop as expected but German Industrial Production fell by 0.4% even if the traders expected a 0.1% growth. Today, the German Final CPI reported a 0.4% drop, matching expectations.

Looking to trade forex now? Invest at eToro!

The short-term bias remains bearish. Hence, more declines are still in the cards. The US dollar dropped significantly, which provided room for Euro buyers.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

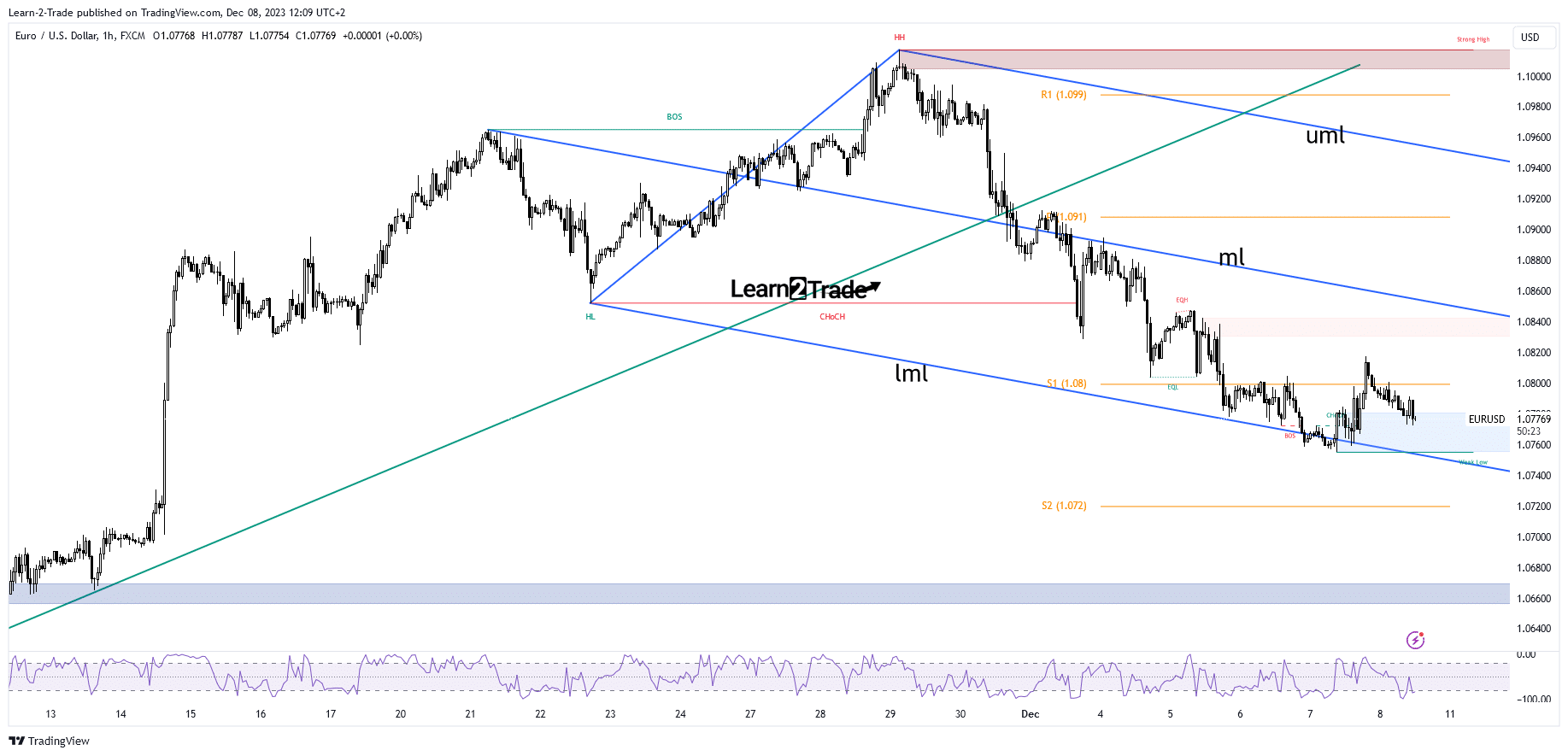

Now, it challenges the demand zone from above the 1.0755 former low. The downside pressure remains high despite temporary rebounds. Staying near the former low and right above the lower median line (lml), the price action may announce an imminent breakdown and a downside continuation. Only staying above 1.0760 and coming back above 1.08 may announce a larger rebound.

From the technical point of view, the EUR/USD price found support on the descending pitchfork’s lower median line (lml). The pair has bounced back but it has failed to stay above the weekly S1 of 1.0800 psychological level.

Later, the US economic figures should move the markets. The Non-Farm Payrolls is expected at 184K in the last month versus 150K in the previous reporting period. Average Hourly Earnings may announce a 0.3% growth, after a 0.2% growth in October, while the Unemployment Rate could remain steady at 3.9%. Furthermore, the Prelim UoM Consumer Sentiment could jump from 61.3 points to 62.0 points.

EUR/USD Price Technical Analysis: Bearish Bias Intact

–Are you interested to learn more about forex options trading? Check our detailed guide-

The EUR/USD price slipped lower after reaching yesterday’s high of 1.0817. The pair is trading at 1.0785 at the time of writing.