Calculations can be as complex or as simple as one defines them. Some strategies use extremely complicated mathematical equations to determine a pattern in price movements. Quantitative trading and algorithmic trading are two expressions for the same concept, often leading to some using quantitative algorithmic trading as the defining idea.

A stock quoted in US dollars in New York may also be quoted in British pounds in London. This may lead to arbitrage opportunities. Arbitrage consists of taking advantage of price differences in two assets that are the same or similar. In the above example, there may be differences in price due to differing demand in the two centers, or the FX rate of GBP/USD may change abruptly leaving a mismatch in price for the asset on the two different exchanges.

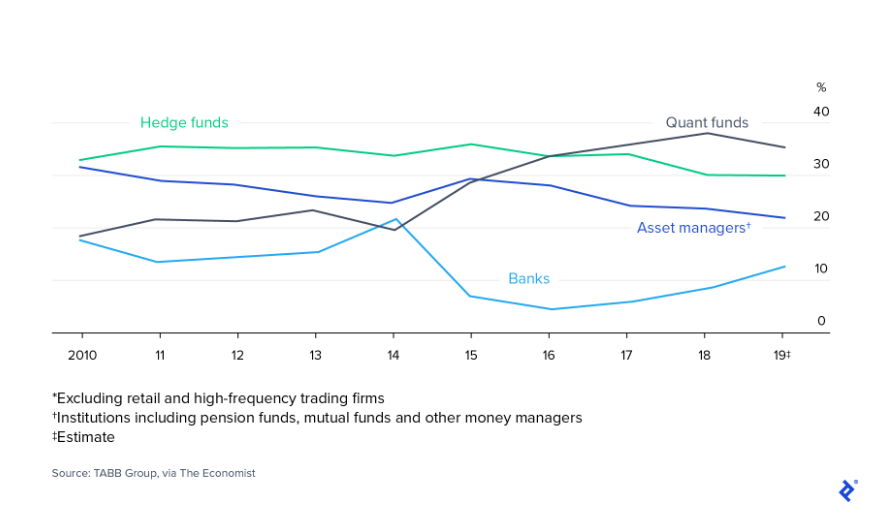

On the whole, it looks like quant hedge funds may be a better choice in terms of return on investment. However, not all funds are equal; great care needs to be taken before allocating your hard earned cash. Some obvious things to ask include – Are they registered, and with whom? Who are the owners, the traders, and the administrators of the fund?

Together with the strategy itself, money and risk management rules need to be defined. Some of the main rules to consider are stop loss, profit target, max number of trades per day, max number of losing trades, max allowable drawdown per day or week, etc. These parameters are often used by retail traders. However, in quant trading, they are embedded in the script and will not be subject to change, unless you change the script itself. This feature creates more discipline in money and risk management.

Forex Quant Trading

Mean reversion strategies attempt to determine when the market will reverse its current price direction. Formulas can be determined by a set of various technical indicators such as RSI or Stochastic Oscillator. The objective is to determine when price reaches a level where its next move is a reversal of the latest price action.

Over the years quant trading has become ever more popular as more investors and institutions set up and design quantitative trading software. Retail traders have also begun to get involved, giving rise to many online platforms offering services to quant traders allowing them to set up their own strategies.

Retail traders need to evaluate their skill set and time availability before jumping into quant trading in a big way. Another option is to invest with an institution that specializes in quantitative trading. Thus gaining exposure to automated trading, at a cost of course, without going thru the steep learning curve.

Quant trading strategies that are typically developed in high volume markets such as EUR/USD may not work as well in lower liquidity environments. Low liquidity is a feature of various crypto markets so the results you get from a strategy that worked fine in a high volume environment may not work as well for some crypto coins. Back testing a strategy on low liquidity markets may not take into account the time-lapse before a trade is actually executed and the possibility of price variations.

Conclusion

Most hedge funds are involved in quantitative stock trading, or quantitative fixed income trading. To gain access to quantitative strategies in forex markets you will need to look for a hedge fund that specifically trades forex. Another option is using a CTA (Commodities Trading Advisor) that trades currency futures or forex under a quantitative model.

In forex, quant trading is split up into three main categories: Trend Following, Mean Reversion, and High Frequency. This differs slightly from stocks and bonds which may also include buy and hold strategies. This model does not allow for short selling and will hold cash instead of selling assets short if there is an expectation of price decline.

We will take a look at the environment for quantitative analysis in trading and discuss what is available to retail traders.

Quantitative Trading Strategies

Many quant strategies tend to be quite complex and involve more than one feature. Many make use of a mix of existing technical analysis tools, such as moving averages, MACD, or channel breakout patterns to define their entry and exit conditions. Others use statistical evaluation and probability functions.

Zorro (zorro-trader.com)

Quantitative trading in cryptos offers a slightly different challenge compared to traditional assets like stocks and currencies. Fundamental analysis in crypto coins is limited, with most factors impacting price coming from headline news. This can be challenging for a quant trading strategy. The headline news may impact price in a totally unexpected way and create volatility which the strategy is unable to handle.

There is a wide array of online platforms where you can implement your quantitative strategies. This includes back testing and model building, using various script languages, or even at the click of a mouse. Some are aimed at institutional or professional traders and can be considerably expensive.

Knowing who the fund’s main actors are is extremely important. If they have nothing to hide all their names should be easily available on request. Last but not least, who are their auditors? Ideally, this company should be one of the top four audit firms, and not have any connections to the fund.

Crypto Quantitative Trading

Quant strategies make use of mathematical computations using price, volume, and sometimes, time data to determine trading opportunities. The data inputs are used to identify patterns of price behavior over time. These strategies are often used by hedge funds and other financial institutions, sometimes known as black-box trading.

Trend following strategies will make use of mathematical formulas that identify a trend. The equations can be as simple as a close above the 50-period average equals a buy signal. Or, a close below the lowest low in 20 periods equals a sell signal.

HFT strategies use mathematical equations to define price action patterns. They are not usually related to technical indicators and the models are a very well-kept secret with the institutions or traders that designed the model. The math behind HFT strategies generally involve statistical concepts such as normal distribution, standard deviation, or mean. They also include common probability distributions. Usually, these factors are linked to short time frames to gain a statistical and probabilistic view of the next price movement.

Quantitative trading sounds like a complex method, something highly specialized and only for experts in the subject matter. It’s true that you will need some level of knowledge in math and data statistics, but it can be easier than it sounds with some study and dedication.

S# (stocksharp.com)

Once the type of strategy has been chosen you will need to define your model and implement back testing to establish possible profitability. Two factors come into play: time frame and data source. The strategy model you have designed may be a total failure on one time frame yet perform positively on another. Data has to come from a reliable source and be clean, meaning void of outliers or momentary spikes or simply incorrect data.

You can check for a list of the best systematic CTAs by performance on the managedfuturesinvesting.com website. The minimum investment amount starts at $ 13K, although in general, the minimum is $ 100K. That said, there are various CTAs that ask for millions as a minimum buy-in to their program. As with hedge funds, all CTAs need to be registered with the CFTC and the NFA.

In general, these differences in prices are not likely to last very long. This is due to market participants who will strive to take advantage of arbitrage opportunities that will necessarily send prices back to parity.

Quantitative Trading Platform

Another quant trading strategy for stocks and bonds is the correlation trade. This model uses an analysis of how often the prices of two assets move in the same direction. It then searches for two assets that have a very high correlation that consistently move in the same direction over time.

Algowizard (algowizard.io)

We are going to take a look at the ones that are free for the most part. Most of these platforms offer data for back testing in various markets such as stocks, ETFs, or cryptos as well as forex. There are many more platforms than the ones listed. We have chosen the ones which we feel are relatively easier to use. We have also looked for ones that offer a complete package for a trader to implement and back test their strategies.

You can also check with your online broker, many offer the capability of automating trades. This will involve some type of scripting languages such as C+ or Python. The use of script means you can make your automated trading strategy as simple or as complex as you like.

منبع: https://forextraininggroup.com/exploring-quantitative-trading-strategies/?utm_source=rss&utm_medium=rss&utm_campaign=exploring-quantitative-trading-strategies

This site is completely free and is based on the Python environment. They do have prewritten templates for analyzing trading strategies. This platform is not very user-friendly, and so a minimum knowledge of coding in Python seems necessary. They have various contests for you to test your quant strategies against other traders. The competition leads to funding for the top 7 ranked traders. The winner receiving $1 million, the 2nd placed receiving $ 500K, the rest receiving incrementally lower allocations for a total of $ 2 million in funds allocated.

Quantitative Trading Companies

Blueshift

This site offers some functions for free, but more complex features come at a cost. This site allows you to build your own quantitative strategy and connect your software to a varied number of online brokers. For more novice traders the site has a graphical environment that allows you to create automated strategies in an easier manner. More advanced features and training courses are available at a cost.

MT4 & MT5

Quant trading refers to the use of computational operations to determine entry and exit points in a systematic manner. Thus eliminating any human intervention once the system is in place. Quant trading strategies are at the heart of all mechanical trading systems. The calculations will usually use price and volume data, although most quantitative forex trading strategies rely solely on price.

The algorithmic formulas are well protected and guarded with extreme care. Hence the term black-box. Most times, not even the investors in the hedge fund are fully aware of what computations the strategies perform exactly. The reason being that the quantitative trading models developed by the fund presumably give them an edge in trading the market. If the other competitors in the market know the inner workings of their model, then they will also be able to replicate it and apply it. And over time the extra alpha (excess returns) generated by using the model will disappear.

On the other hand, this market relies heavily on technical analysis for day to day trading which may mean that automating these strategies within the quantitative spectrum could prove successful. In similarity to stocks, the main data used for trading cryptocurrencies are price and volume. Combining rules associated with both sets of data should prove more rewarding.

This platform allows you to create basic quantitative strategies at the click of a mouse. The platform offers a library of templates that you can define to model a strategy for entry and exit points based on various technical indicators and candle chart patterns. The number of back testing runs is free with a monthly limit; extra back testing is available at a cost.

High-Frequency Trading (HFT) will use formulas that create many trading opportunities for small changes in price. HFTs generally use tick data or at the most one minute periods, to define the next movement in price. Hedge funds, CTAs and financial institutions are most likely to be using this type of strategy.

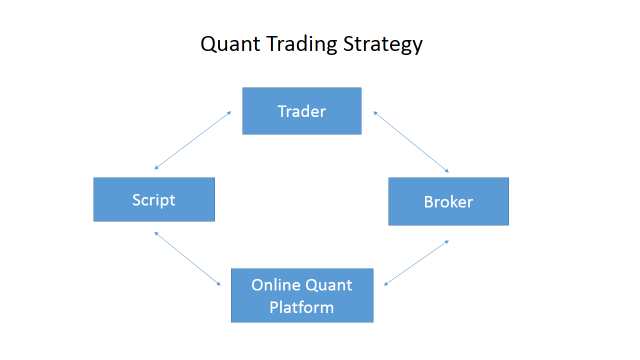

Apart from the calculations to define entry and exit of a trade, quant trading strategies also execute trading orders automatically. Once all conditions have been met by the program it executes the open or close order independently, without any further human intervention. Even if these trades may be placed manually, the main concept is that the decision-making is completed by the mathematical equation.

Quant trading institutions are a good option to gain access to the possible generation of alpha. In most countries, you will have to be an accredited investor or a high-net-worth individual to be able to invest in these types of companies. For the most part, they are set up as hedge funds and depending on their location of incorporation may bring tax breaks as well.

Relatively extreme deviations from the average difference in price create arbitrage opportunities by selling the asset that has risen most and buying the asset that has underperformed. When looking at stocks beware of headline news that can change the current direction of an asset yet not affect the highly correlated peer involved in the arbitrage trade.

This platform offers tools for those traders with script knowledge in C, Python, and R. For those that are willing to learn how to code, the site has various videos that offer education on coding. It does offer according to its landing page an “institutional grade development tool”. You can implement strategies in various markets such as forex, ETFs, stocks, and options.

The chart above shows that over the years quantitative strategy hedge funds have managed to catch up with their regular peers. After matching the returns of regular hedge funds in 2016 quant funds started outperforming them in 2017, and the trend seems to have continued. Quant strategy performances can be dire in times of crisis as the market’s typical patterns are broken and the signals the trading model supplied before are no longer as relevant.

The objective of trend strategies is to try and define the current direction and take positions that are in line with them. An example of a common trend strategy is the double moving average crossover. This strategy opens a buy trade when fast moving average closes above the slow moving average. When the fast moving average closes below the slow moving average the strategy opens a sell trade.

This website is free with built-in tools to code your strategies with their visual block builder. You can also code your strategies from scratch using Python. It is aimed at stock traders, however, it can also work for forex traders. No live trading is available at the time of writing. You may run as many back tests as you want. Other markets such as indices or commodities are not currently available, and for forex, only the one-minute time frame is offered.

Quantiacs (quantiacs.com)