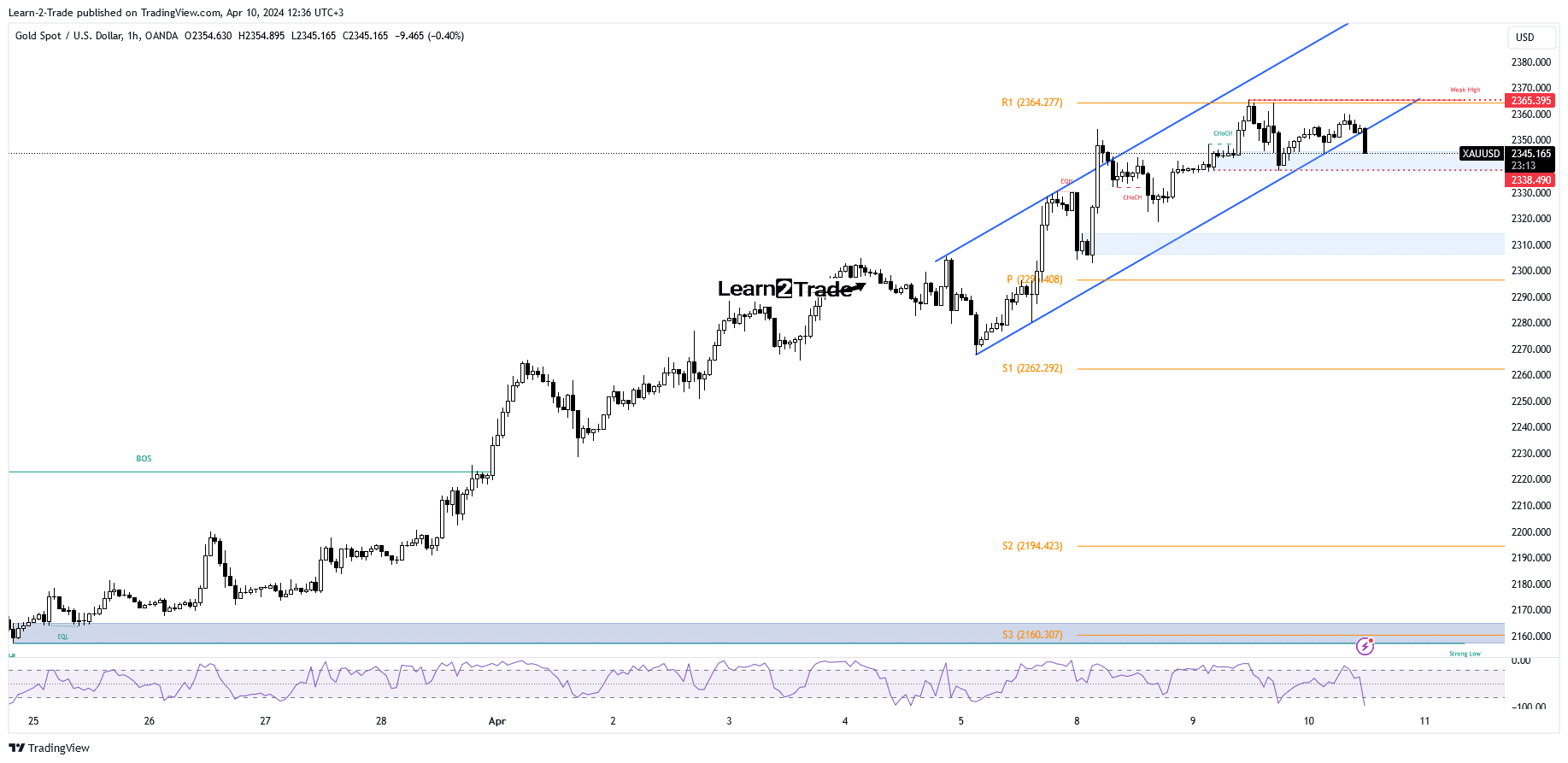

On the other hand, false breakdowns may announce a new bullish momentum. Still, only a new higher high, a bullish closure above $2,365, activates further growth.

Higher inflation could lift the greenback and punish the yellow metal. The volatility should be high before and after the US data dump.

Furthermore, the FOMC Meeting Minutes and the BOC also represent high-impact events. The Bank of Canada should keep the Overnight Rate at 5.00%, but the FOMC minutes could change the sentiment.

Gold Price Technical Analysis: Bearish Formation

Looking to trade forex now? Invest at eToro!

Later, the US Consumer Price Index could report a 0.3% growth in the last month versus a 0.4% growth in February. The CPI y/y may announce a 3.4% growth after a 3.2% growth reported in the previous reporting period, while the Core CPI is expected to register a 0.3% growth.

Technically, the XAU/USD found resistance at the weekly R1 of 2,364, and now it challenges the uptrend line, which is the flag’s support. It has dropped below this dynamic support, but the breakdown could still be invalidated.

–Are you interested in learning more about buying NFT tokens? Check our detailed guide-

Today, anything could happen, as the economic calendar is filled with high-impact events. The RBNZ left the monetary policy unchanged, so the Official Cash Rate remained 5.50%.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

The gold price climbed as high as $2,365 in the last trading session, marking a fresh all-time high. The metal has now retreated a little and is trading at $2,345 at the time of writing.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.